PSEC Menu

Offering Highlights

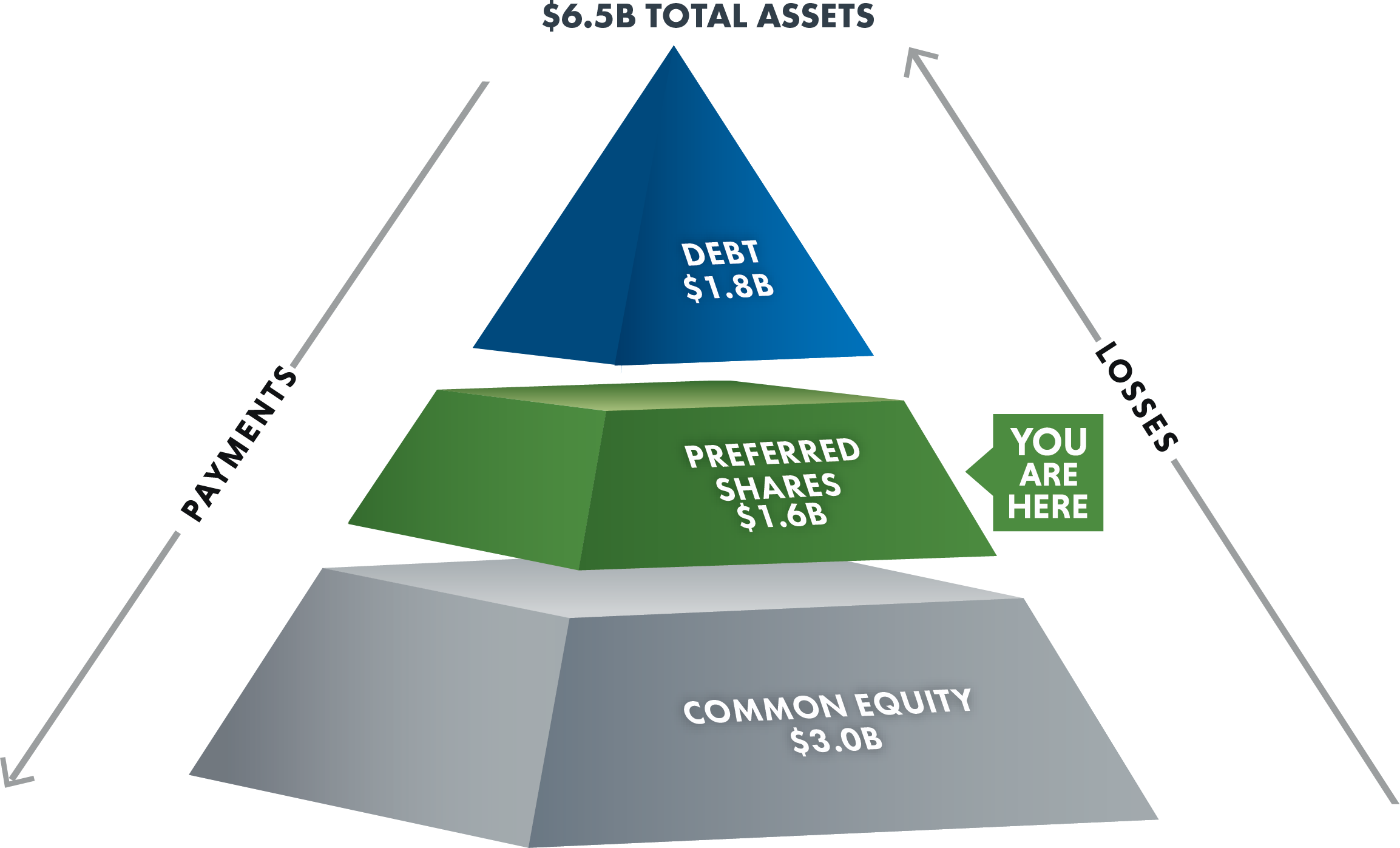

Preferred shareholders are paid before common stock shareholders. Shareholder interests are strongly aligned with PSEC management team.

1Series A5 – 5 year declining redemption fee (10%,10%,10%,8%,5%,0%) and Series M5 – 180 day dividend recapture in the first year and a 90 day recapture in the second year.

Dividends are not guaranteed and paid as authorized by the board of directors.

Benefit of PSEC Preferred Stock

$3.0B

buffer of common equity

subordinate to the preferred

shareholders

28%

management ownership of

common equity aligns

with investor interests

Senior Position

Preferred shareholders must receive 100% of their dividend payments prior to the common shareholders getting paid any dividends.

Defensive By Design

55.6% loan to asset value leverage.

Per 1940 act – leverage is limited to

150% asset coverage

Why Prospect Capital

4 The issuer rating may differ from the preferred rating depending on series and agency.

Past Performance is not indicative of future results.

RISK FACTORS & DISCLOSURES

An investment in Prospect Capital Preferred Stock involves certain risks, including the risk of a substantial loss of investment. You should carefully consider the information set forth in the “Risk Factors” section of the prospectus supplement and the prospectus for a discussion of material risk factors relevant to an investment in Prospect Capital Preferred Stock, including but not limited to the following:

- The Preferred Stock will be subject to a risk of early redemption at our option and holders may not be able to reinvest their funds.

- Holders of the Preferred Stock will bear dividend risk. We may be unable to pay dividends on the Preferred Stock under some circumstances. In addition, the terms of any future indebtedness we may incur could preclude the payment of dividends in respect of equity securities, including the Preferred Stock, under certain conditions.

- There is limited liquidity and no public trading market for the PSEC Preferred Stock and there is no guarantee that the Preferred Stock will be listed on a national securities exchange.

These and other risks may impact the company’s financial condition, operating results, returns to its investors, and ability to make distributions as stated in the company’s prospectus.

Investors should consider the investment objectives, risks, charges and expenses of the investment company carefully before investing. The prospectus supplement and the prospectus contain this and other relevant information. Investors should read the prospectus supplement and prospectus carefully before investing.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED ANY OFFERING OF PROSPECT CAPITAL CORPORATION. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THIS IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES DESCRIBED HEREIN. AN OFFERING IS MADE ONLY BY THE PROSPECTUS. THIS MATERIAL MUST BE PRECEDED OR ACCOMPANIED BY A PROSPECTUS. ALL INFORMATION CONTAINED IN THIS MATERIAL IS QUALIFIED IN ITS ENTIRETY BY THE TERMS OF THE PROSPECTUS. THE ACHIEVEMENT OF ANY GOALS IS NOT GUARANTEED.