PSEC Menu

About Prospect Capital (PSEC)

Founded in 1988, Prospect Capital is one of the largest investment-grade rated business development companies on NASDAQ.

Portfolio Diversification & Investment Strategies

Middle-Market Lending

Senior and secured loans to U.S. middle-market companies.

Middle-Market Lending / Buyouts

Senior and secured loans plus control private equity to U.S. middle-market companies.

Real

Estate

Fully developed class B /C multi-family residential properties with value-add potential in secondary / tertiary markets.

Subordinated

Structured

Notes

Diversified pools of senior and secured loans to large U.S. companies, which loans have a first lien on corporate assets.

Other

Primarily diverse pools of fixed income investments.

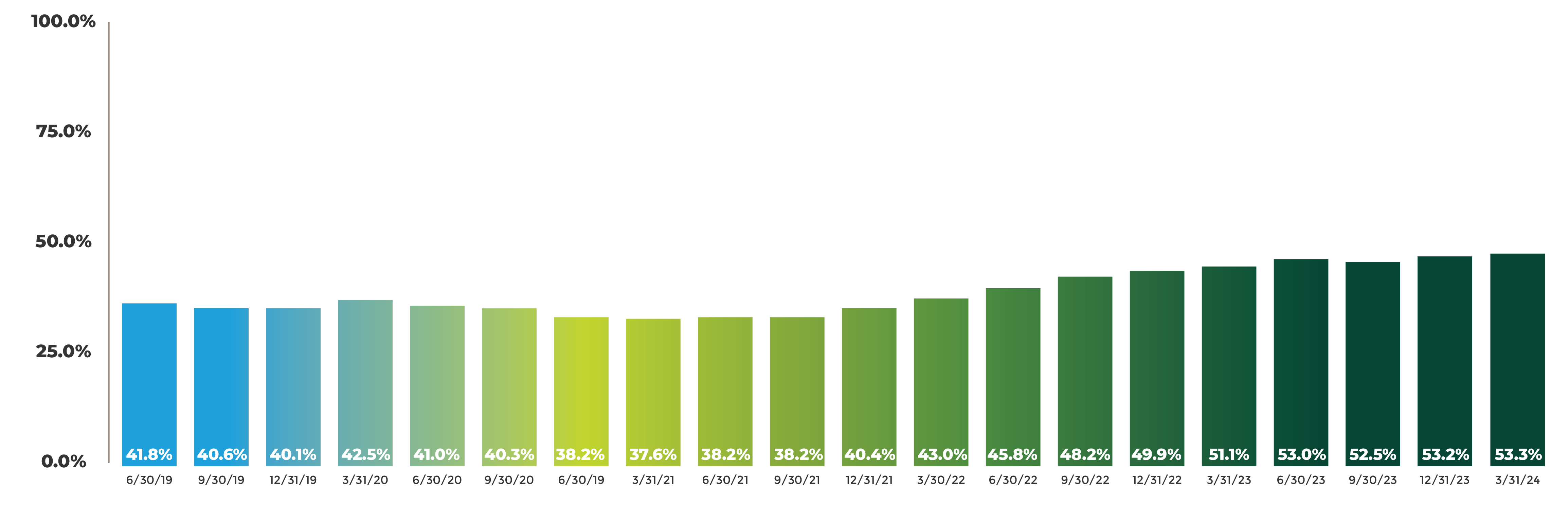

Consistently and Conservatively Leveraged

53.3%

invested loan-to-asset-value leverage 1

1Loan-to-asset value leverage calculated as (Principal Debt Outstanding + Total Preferred Outstanding) / Total Assets

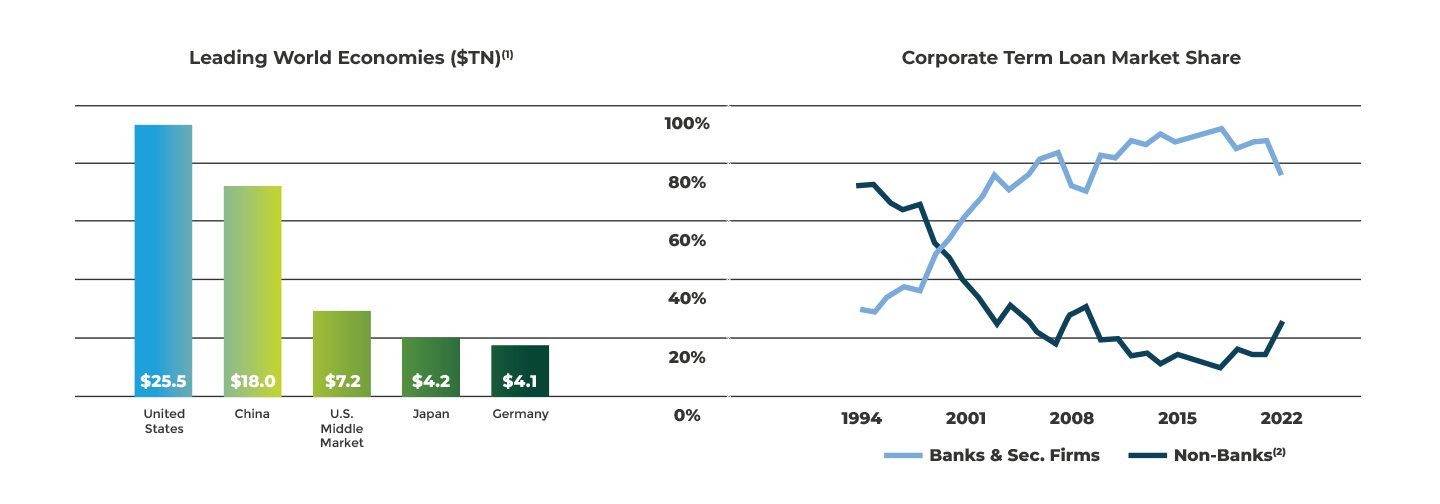

Why Middle Market Lending?

Large market size with 200,000 private US businesses that make up 33% of Private GDP.

(1) Source: National Center for the Middle Market, US Bureau of Economic

Analysis, and The World Bank as of December 31, 2022.

Note: Financial data as of December 31, 2022.

Source: S&P Caapital IQ. (2) Institutional Investors and finance companies.

Investment Portfolio

Why Invest in PSEC

With 20 years as a publicly traded BDC, Prospect Capital has provided consistent returns to shareholders using a disciplined approach to investing in the U.S. middle market.

Attractive Dividend Yield

Focus on Senior and Secured Lending

Conservative, Strong Capitalization

Dividend Reinvestment Plan

Broad Investment Portfolio

Large and Experienced Team

Past performance is not indicative of future results.

RISK FACTORS & DISCLOSURES

An investment in Prospect Capital Preferred Stock involves certain risks, including the risk of a substantial loss of investment. You should carefully consider the information set forth in the “Risk Factors” section of the prospectus supplement and the prospectus for a discussion of material risk factors relevant to an investment in Prospect Capital Preferred Stock, including but not limited to the following:

- The Preferred Stock will be subject to a risk of early redemption at our option and holders may not be able to reinvest their funds.

- Holders of the Preferred Stock will bear dividend risk. We may be unable to pay dividends on the Preferred Stock under some circumstances. In addition, the terms of any future indebtedness we may incur could preclude the payment of dividends in respect of equity securities, including the Preferred Stock, under certain conditions.

- There is limited liquidity and no public trading market for the PSEC Preferred Stock and there is no guarantee that the Preferred Stock will be listed on a national securities exchange.

These and other risks may impact the company’s financial condition, operating results, returns to its investors, and ability to make distributions as stated in the company’s prospectus.

Investors should consider the investment objectives, risks, charges and expenses of the investment company carefully before investing. The prospectus supplement and the prospectus contain this and other relevant information. Investors should read the prospectus supplement and prospectus carefully before investing.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED ANY OFFERING OF PROSPECT CAPITAL CORPORATION. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THIS IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES DESCRIBED HEREIN. AN OFFERING IS MADE ONLY BY THE PROSPECTUS. THIS MATERIAL MUST BE PRECEDED OR ACCOMPANIED BY A PROSPECTUS. ALL INFORMATION CONTAINED IN THIS MATERIAL IS QUALIFIED IN ITS ENTIRETY BY THE TERMS OF THE PROSPECTUS. THE ACHIEVEMENT OF ANY GOALS IS NOT GUARANTEED.