PIF Menu

Offering Highlights

1Distribution is composed of 9.02% annualized base distribution plus a 2.49% annualized bonus distribution. Distributions are not guaranteed and are intended to be paid monthly, as authorized by the board of directors.

Past Performance is not indicative of future results.

Senior Secured Loans

Priority Income Fund invests in pools of first lien, senior secured loans to large U.S. companies.

Principal protection through:

- Highest priority in the capital structure

- First lien on borrower’s assets

- Restrictive financial covenants

Yield protection through floating rates and floors

Typical borrower:

- Average loan size of $1.08B

- EBITDA of $100M+

- Rated by Moody’s and S&P

Portfolio Characteristics

Share Options

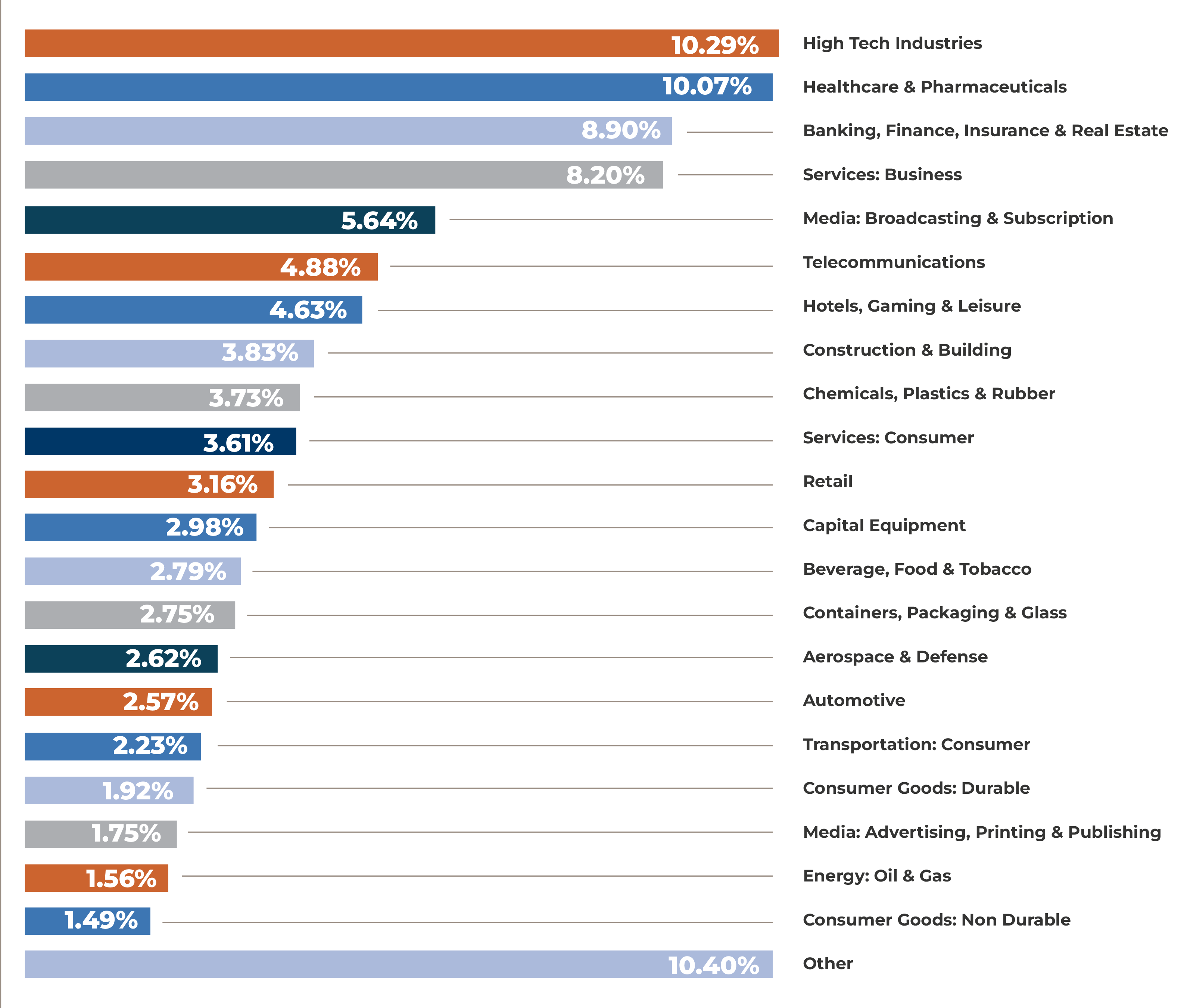

Industries of underlying senior secured loans

RISK FACTORS & DISCLOSURES

An investment in shares of Priority Income Fund, Inc. (the “Fund”) involves substantial risk and may result in the loss of principal invested. There can be no assurance that the Fund’s investment objective will be met. This Fund may not be suitable for all investors. You should carefully read the information found in the Fund’s prospectus, including the “Risk Factors ” section, before deciding to invest in the Fund’s shares. These risks include but are not limited to:

- The Fund seeks to achieve its objective by investing at least 80% of its total assets in senior secured loans made to companies whose debt is rated below investment grade. Senior Secured Debt involves a greater risk of default and higher price volatility than investment grade debt.

- The fund will invest in equity and junior tranches of collateralized loan obligations (“CLOs”), which may be riskier than a direct investment in the underlying companies.

- CLOs will typically have no significant assets other than their underlying Senior Secured Loans.

- Our shares are not currently listed on any securities exchange, and we do not expect a public market for them to develop in the foreseeable future, if ever. Therefore, stockholders should not expect to be able to sell their shares promptly or at a desired price. No stockholder will have the right to require us to repurchase his or her shares or any portion thereof. Because no public market will exist for our shares, and none is expected to develop, stockholders will not be able to liquidate their investment prior to our liquidation or other liquidity event, other than through our share repurchase program, or, likely in limited circumstances, as a result of transfers of shares to other eligible investors.

- The Fund’s investment strategy involves investments in securities issued by foreign entities, which will expose investors to risks not typically associated with investing in U.S. securities.

- The Fund may invest a substantial percentage of its portfolio in securities that are considered illiquid, which may prevent the advisor from readily disposing of securities at favorable prices.

THIS IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES DESCRIBED HEREIN. AN OFFERING IS MADE ONLY BY PROSPECTUS.

Investors should carefully consider the investment objectives and risk factors of the Priority Income Fund. This and other important information about the Fund are contained in the prospectus which should be read carefully before investing.

The Fund is distributed by Foreside Fund Services, LLC. Preferred Capital Securities, LLC (“PCS”), Member FINRA/SIPC, is an authorized wholesaler of the Fund pursuant to a marketing agreement with Liberty Street Advisors, Inc. (“LSA”), the adviser to the Fund. LSA, PCS and Foreside are not affiliated entities. PCS does not endorse or accept responsibility for the content of any third-party web site.

The Fund is distributed by Foreside Fund Services, LLC. Preferred Capital Securities, LLC (“PCS”), Member FINRA/SIPC, is an authorized wholesaler of the Fund pursuant to a marketing agreement with Liberty Street Advisors, Inc. (“LSA”), the adviser to the Fund. LSA, PCS and Foreside are not affiliated entities. PCS does not endorse or accept responsibility for the content of any third-party web site.